- -Ethiopia welcomes Russian oil, gas companies

- -Ethiopia eyes new oil exploration areas

- -Ethiopia: Petronas Signs Gas Development Agreement

- -Ethiopia to Tender Blocks in Ogaden Basin

- -Ministry to Revoke SIL's Petroleum Development License (January 14, 2006)

- - SIL to invest 1.5 billion USD in the mining industry (Dec 30, 2003)

- - Calub to be given to private compnaies on concession (Feb 19, 2003)

- - Russians sign for 50 percent shares in Calub (February, 2002)

- - World Bank Leaves Off Extending Loans to Calub (August 19 - 26, 2001 )

- - American Company Contemplates Calub Gas Exploitation (August 2001)

- - Africa "Key Source" for Energy Supply and Development Senior U.S. energy

official testifies before Congress March 16 2000

- - Sicor plans 375-mi Ethiopian pipeline - January 2000

- - Small firm signs $1.4 billion deal to develop gas project in Ethiopia:

December 1999

- - Ethiopia Signs $1.4 Billion Deal With U.S. Firm Sicor: Reuters; December

9, 1999

- - A Second Wind For Calub Gas February 1999

- - Ethiopia withdraws bid for sale of gas company February 02, 1999

- - Inventory of fossil fuel extraction projects financed by World Bank Group,

mid-1992 to 1997

- TAARIIKHDA SHIDAALKA OGAADENIYA

Ethiopia welcomes Russian oil, gas companies

February 13, 2008 (MOSCOW) -– Ethiopian Trade and Industry

Minister Girma Birru said Wednesday that the Ethiopian government welcomed

Russian oil and gas companies’ plans to develop deposits in Ethiopia.

The visiting minister was speaking following a meeting of a

Russian-Ethiopian government commission.

Birru said that, in particular, Russian oil major Lukoil was

seeking to develop oil and gas fields in the country.

In the eighties the Soviet Petroleum Exploration Expedition

(SPEE) drilled nine deep gaz wells from 1982 to 1993 in the region of Calub.

The Calub gas reserves are estimated at 2.7 trillion cubic feet

(TCF) while the Hilala gas reserves are estimated at 1.3 TCF. Ethiopia also

plans to lay two pipelines - 80 km from Hilala to Calub and 700 km from Calub to

Dire Dawa.

Different countries, China, India, Malaysia and the British

White Nile company showed interest in Ethiopia’s oil exploration however the

political instability particularly in Ogaden which is believed to contain huge

amounts of oil reserves hinder the economic exploitation of oil resources.

Also, the Gambella basin is one of the five sedimentary basins

found in Ethiopia, which are expected to be oil prospective.

(ST)

Source:

http://www.sudantribune.com/

Ethiopia eyes new oil exploration areas

The Reporter (Addis Ababa)

Saturday, 19 January 2008

Though

there are five sedimentary basins believed to be prospective for oil discovery

in Ethiopia, much of the oil exploration activities hitherto have been carried

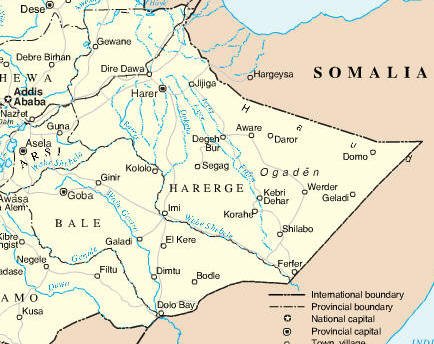

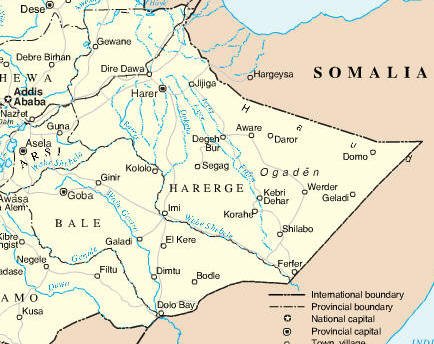

out in the Ogaden basin, eastern part of the country. The Ogaden, Gambella, Omo

Valley, Abay Gorge and Mekelle are the five sedimentary basins found in

Ethiopia. Though

there are five sedimentary basins believed to be prospective for oil discovery

in Ethiopia, much of the oil exploration activities hitherto have been carried

out in the Ogaden basin, eastern part of the country. The Ogaden, Gambella, Omo

Valley, Abay Gorge and Mekelle are the five sedimentary basins found in

Ethiopia.

After the huge amount of oil discoveries in the 1930s in some Middle Eastern

countries, international petroleum companies became interested in the Ogaden

basin, whose age is equivalent to that of the basins in Saudi Arabia and Yemen.

Studies indicate that the geological formation of the Ogaden basin and its

maturity is similar to some of the basins in the Middle East.

The history of oil exploration in the Ogaden basin dates back to the early

1940s. Several companies undertook exploration activities in the region during

the imperial regime. Sinclair (American), Elwerath (German), Voyager Group

(Canadian), and White Stone (American) are some of the international companies

which had undertaken geological surveys in the region between 1944 to 1975. The

American oil company Tenneco, which conducted an extensive seismic survey and

drilled several exploration wells, discovered a natural gas reserve in Calub and

Hilala localities in 1972. Some eight companies conducted different geological

studies in the Ogaden basin during the imperial regime. Later on, during the

Derg regime, the Russian company Soviet Petroleum Exploration Expedition (SPEE)

conducted seismic surveys that covered thousands of squares of kilometers. The

company was operational in the Ogaden from 1979 to 1992.

SPEE collected numerous geological data and drilled dozens of exploration

wells. It also drilled exploration and gas production wells in the Calub and

Hilala gas fields. The company also confirmed the gas reserves discovered by

Tenneco. The gas reserve in the two localities is estimated at 116 billion

cu.meters.

In the early 1990s, two American companies-Maxus and Hunt Oil-conducted

petroleum studies in the Ogaden basin. Both companies conducted seismic serveys

and Hunt Oil drilled one well which turned out to be dry. However, oil and gas

inflows were noted in several wells drilled at different times in El Kuran,

Hilala, Sillabo and Magan. A small amount of non-commercial crude oil reserve

was also discovered in Hilala. For one or other reason all the companies focused

on Ogaden. So far, 48 wells have been drilled in Ethiopia and 46 of are in the

Ogaden while two are found in the Gambella basin.

Until recently, there was no company which was interested in exploring the

other sedimentary basins. The Malayisian oil and gas giant, Petronas, was the

first company to engage in exploration project in the Gambella basin . In June

2003, Petronas and the Ethiopian Ministry of Mines and Energy(MME) signed a

petroleum exploration and production sharing agreement (PSA), which entitles the

company to prospect for and develop petroleum resources in the Gambella block on

a 16,000 sq.km of land. Since 2004, Petronas has been conducting seismic surveys

and has drilled two exploration wells in Jikaw and Jacaranda localities. Both

wells were dry (no gas and oil show).

The Gambella and Omo Valley are the extensions of the oil productive Muglad

and Melut basins of neighboring Sudan. Jikaw is only 175 kms east of the Sudan

border. “You can not ascertain if there was oil in the region by drilling only

two exploration wells,” says Abiy Hunegnaw, petroleum operations department head

with MME. Petronas, which is also engaged in oil exploration and production

activities in the Sudan, anticipates to drill more wells in the Gambella basin.

In August 2005, it acquired three exploration blocks in the Ogaden. It also

agreed to develop the gas reserve in the Calub and Hilala localities. The

company has signed a petroleum development agreement which enables it to extract

the gas reserve. Pexco, another Malaysian company, South West Energy, a company

registered in Hong Kong, and Lundin Petroleum, a Swedish company, have also

concession rights in the Ogaden basin. In 2005, Afar Exploartions, an American

company signed an exploration and PSA with the MME to prospect for oil in the

Afar regional State. Afar exploration was the second company to be granted a

concession outside right the Ogaden basin.

Currently, the company is conducting airborne magnetic and gravity surveys in

the Afar region. A local company called K and S has also been conducting a joint

geological study with MME in the North Wollo Zone of the Amhara Regional State.

Recently, a US-based company called Inter Global has requested MME to be granted

an oil exploration license which entitles it to prospect for oil in the Afar,

Tigray and east Amhara region.

The escalating price of oil has boosted oil exploration industry. A few years

ago, there wasn’t a single company engaged in an exploration project. MME's

efforts to attract potential investors have borne fruit in bringing in some five

foreign companies. The companies are now significantly contributing to the FDI

flow to the country.

South West Energy has also requestyed to sign a joint study agreement (JSA)

with MME with a view to conduct a geological study in a locality near Jimma

town, in the Oromia Reginal State.

As more companies come to Ethiopia, the MME wants to assign them to different

regions which are believed to be prospective for oil. There are 21 exploration

blocks in the Ogaden basin, 17 of which have already been occupied. Only four

are available for investors. However, the remaining blocks are less prospective

compared to the other blocks in the region. The ministry wants petroleum

companies to see the potentials of other sedimentary basins in Ethiopia instead

of concentrating only on Ogaden.

The British oil and gas company,White Nile Limited, last Tuesday signed a

petroleum exploration and production sharing agreement with MME which grants it

the right to prospect for and develop petroleum resources in the Omo Valley

found in the Southern Nations, Nationalities and Peoples, National Regional

State.

White Nile is an oil and gas exploration company listed in the Lodon Stock

Exchange and operates mainly in Southern Sudan and the surrounding region. Nile

Petroleum Corporation and National Oil Company of Southern Sudan have a major

equity stake in the company.

The Omo Valley is part of the East Africa Rift. It recently became attractive

for oil exploration activity because of the oil discovery in Uganda and

Southern Sudan. White Nile and MME have signed a two year Joint Study Agreement

(JSA). In the past two years, White Nile and the Petroleum Department of MME

jointly evaluated the petroleum potential of the area and its relationship with

the Southern Sudan basins as well as the northern Kenya rift basins.

MME has revealed that White Nile acquired 29,465 sq.km of land in the Omo

Valley, adding the company will pay one million signature bonus to the

government of Ethiopia. The ministry said the company will pay 200,000 dollars

per year for community development and allocate a fund to train Ethiopian

personnel in the field of petroleum exploration and development programmes.

Mr Philippe Edmonds, Chairman and CEO of White Nile, said the company had

noted encouraging results during the JSA. He indicated that the company will

start conducting seismic surveys at the end of this year. Edmond said the

company has allocated 15 million dollars for its project. Experts of White Nile

told The Reporter that the Omo valley sedimentary basin was thick enough for the

discovery of oil. The Omo Valley and Gambella basins are extensions of the oil

productive Muglad and Melut basin in the Sudan.

“As the East Africa basins are becoming attractive, I hope your exploration

work will be successful,” Alemayehu Tegenu, Minister of Mines and Energy said to

Mr. Edmonds. “The agreement we signed with White Nile is the first in this

Ethiopian millennium. In the new millennium, we have to strive more than before

to satisfy our society's needs and to minimize the foreign currency used for

petroleum import,” Alemayehu also said.

So far the government of Ethiopia issued 12 petroleum exploration and one

development licenses.

By Kaleyesus Bekele

Ethiopia: Petronas Pays 80

Million Dollars for Gasfields

The Reporter (Addis Ababa)

22 September 2007 By Kaleyesus

Bekele

The Malaysian oil and gas

company Petronas last month paid

the Ethiopian government 80

million dollars for the Calub

and Hilala natural gas fields in

the Ogaden basin, south-east

Ethiopia.Pertonas

won the international tender put

up by the Ethiopian Ministry of

Mines and Energy (MME) to

privatize the Calub and Hilala

gas fields found in the Somali

Regional State. The ministry put

up the tender in April 2006

inviting petroleum companies

interested in developing the two

gas fields discovered in 1973.

In August 2006, MME announced

that Petronas was the winner.

After a long negotiation on

the details of the gas

development project last June

MME and Petronas signed

petroleum development agreement

and production sharing agreement

(PSA), which enables the latter

to extract and market the gas

reserves in Calub and Hilala

localities. Recently, Petronas

paid the 80 million dollars

pre-development cost Ethiopia

invested on the gas fields.

A senior government official

told The Reporter that the

signing of the gas development

project and the predevelopment

cost payment were big

achievements for MME. “Eighty

million dollars is a big sum.

The ministry has never received

this amount of payment,” the

official said.

The natural gas reserve in

Calub and Hilala is estimated at

four trillion cubic feet (4TCF).

The gas fields that covers 285

sq m are found 1, 200 km

south-east of Addis Ababa. The

gas fields were first discovered

by an American company called

Tenneco during the reign of

Emperor Haile-selassie. Tenneco,

which drilled three wells in

Calub and one in Hilala, was

forced to withdraw because of

the 1974 revolution that toppled

Emperor Haile-selassie.

The Soviet Petroleum

Exploration Expedition (SPEE),

which drilled additional wells

in Calub and Hilala in the 1980s

and early 90s, confirmed the gas

reserves. SPEE drilled seven

wells in Calub and three in

Hilala, 80 km from Calub. In

1998 the Chinese petroleum

company, Zhoungyan Petroleum

Exploration Bureau (ZPEB),

contracted by the Ethiopian

government, made eight of the

wells in Calub ready for

production. ZPEB was paid 5.6

million dollars for the well

completion work.

Several companies which have

shown interest to develop the

gas fields held negotiations

with the Ethiopian government.

Secor, an American company,

Methanol Joint Stock and Stroy

Trans Gas, Russian companies

were some of the companies which

held negotiations with the

government. Although these

companies signed memorandums of

understanding (MOU) on different

occasions none of them were able

to sign final agreement for

various reasons.

Another company, which was

interested in developing the gas

fields, was SI Tech

International (SIL). The

Jordanian Company, SIL, signed

petroleum development agreement

and PSA in 2003. However, the

company was unable to commence

work on the project until 2006.

Alemayehu Tegenu, Minister of

MME, revoked the petroleum

development license given to SIL

and decided to tender the

project.

Petronas has been projecting

for oil in the Gambella basin,

western part of Ethiopia and in

different localities in the

Ogaden basin. The company took

over the Gambella block covering

16, 000 sq km of land in 2003.

In 2005, the company secured

three blocks in the Ogaden

basin. The exploration blocks

are found in Wel-Wel, Warder,

Fer-Fer and Genale localities in

the Ogaden basin. The total

exploration area is 93,000 sq

km. The company paid over five

million dollars in signature

bonus.

The company offered training

programs for over 20

professionals working in the MME

and it is also engaged in

community development projects

in the Gambella region. As part

of its assistance to the

ministry, the company upgraded

ageing petroleum data collected

from the Ogaden basin by

different Companies.

Petronas proposed to build a

gas processing plant and to

construct a gas pipeline that

stretches from the Calub and

Hilala gasfields all the way to

the Pot of Djibouti. In addition

to the gasfields, MME granted

Petronas two exploration blocks

called B l1 and 15. B 11 and 15,

which are very close to the

gasfields believed to be the

most promising areas for oil

discoveries. Oil were noted in

Calub and Hilala as wel as in

bll and 15.

Petronas plans to drill

exploration wells in these

areas. The company proposed to

invest up to 1.9 billion dollars

for the petroleum exploration

and development project. The

construction of the gaspipeline

and the gas processing plant

could take over three years.

If the gas development

project comes to fruition,

Ethiopia for the first time,

would be a hydrocarbon producing

country. Petronas will pay a 35

percent income tax payment and

three percent royalty fee to the

Ethiopian government. The

government will also have a 5

percent share from the annual

gas production.

Petronas, wholly owned by the

Malaysian government, operates

in 35 countries in Asia and

Africa. It is engaged in oil

exploration and production

project in African countries

like Sudan, Chad and Angola.

Petronas, which was established

in 1974, is one of the top ten

leading oil companies in the

global oil industry.

Source: 2007 The Reporter.

7 August 2007: Malaysia Signs Gas Development Agreement

with Ethiopia

The Malaysian oil company Petronas and

Ethiopia’s Ministry of Mines and Energy (MME) have signed a gas

development agreement that would enable the company to develop

the natural gas reserve in the Calub and Hilala areas in east

Ethiopia’s Somali State, The Reporter said Saturday. The English

weekly newspaper reported that the agreement was signed by

Petronas President Mohamed Hassan Marican and Alemayehu Tegenu,

minister of MME, in Malaysia’s capital Kuala Lumpur. Petronas

has won the2006 international tender by the MME to award the

Calub and Hilala gas fields in the Ogaden basin.

http://www.iss.co.za/index.php

Ethiopia: Petronas Signs Gas Development Agreement

The Reporter (Addis Ababa)

4 August 2007

Posted to the web 5 August 2007

Kaleyesus Bekele

Addis Ababa

The Malaysian oil and gas company, Petronas, and the Ethiopian Ministry of Mines

and Energy (MME) last month signed a petroleum development agreement and

production sharing agreement (PSA) that would enable the company to develop the

natural gas reserve in the Calub and Hilala localities in the Somali Regional

State.

The agreement was signed by Alemayehu Tegenu, minister of MME and Dato Mohammed

Hassan Merrican, president of Petronas in Kuala Lumpur, Malaysia. Petronas has

won the international tender put up by the MME to award the Calub and Hilala gas

field in the Ogaden basin a year ago. In July 2006, the MME sent an awarding

letter to Petronas and since then the two parties have been negotiating on the

details of the gas fields development project in Addis Ababa and Kua Lalampur.

Petronas has also secured two exploration blocks (B11&15) in the Ogaden basin.

The blocks are found in the vicinity of the Calub and Hilala gas fields.

Petronas plans to build a gas processing plant and to construct a gas pipeline

that stretches from the gas fields to a seaport. In addition to extracting the

gas reserve, the company plans to conduct seismic serveys and to drill

exploration wells in the gas fields as well as in block 11 and 15.

The Calub and Hilala natural gas fields are located 1,200 km south-east of Addis

Ababa. The total area of the gasfields is 285sq.km.

The gas reserve, estimated at 113 billion cu. m. (4TCF), was first discovered by

an American company, Tenneco, in 1972. Later on the reserve gas was confirmed by

the Soviet Petroleum Exploration Expedition (SPEE). Ten wells were drilled in

Calub and four in Hilala. Non commercial oil reserve was discovered in Hilala by

Tenneco. Block 11 and 15 where oil and gas shows were discovered are considered

to be one of the most promising exploration areas in the Ogaden basin. In August

2005 Petronas acquired exploration areas in the Genale, Warder, Fer Fer and Wel

Wel localities in the Ogaden basin. The company has also been prospecting for

oil in the Gambella basin, south-west Ethiopia.

Petronas, one of the top ten leading international oil companies in the world,

was established in 1974. Wholly owned by the Malaysian government, the company

has 110 subsidiary companies. Petronas operates in 14 African and 21 Asian

countries. The company is active in the Sudan, Chad, Cameroon, Angola and Yemen.

Source: http://www.ethiopianreporter.com/

Ethiopia to Tender Blocks in Ogaden Basin

Alexander's Gas & Oil Connections

volume 12, issue #5 - Wednesday, March 14, 2007

17-02-07

The Ministry of Mines and Energy (MME) is to tender two oil exploration blocks

in the Ogaden basin, in eastern Ethiopia. The ministry will put up an

international tender that will be inviting petroleum companies interested in

engaging in oil exploration activity in the concession areas called Block 7 and

8. The blocks are found in the Ogaden basin in the Somali Regional State. There

are about twenty blocks in the Ogaden basin and 16 of them were given to

different companies.

Alemayehu Tegenu, Minister of MME, told that three companies had asked the

ministry to be given block seven and eight. Alemayehu said since different

companies had shown interest to acquire the blocks the ministry opted to float a

tender. Alemayehu added that the ministry was preparing tender document to be

soon put on an international tender.

Petronas, Pexco, Lundin and South West have concession areas in the Ogaden

basin. The basin covers 350,000 sq km. of land. The Malaysian oil and gas

company, Petronas, acquiredfour blocks in Genale, Kelafo, Warder and Ferfer

localities covering 93,000 sq km of land. The agreement was signed in August

2005. Currently Petronas is undertaking a seismic survey in Genale locality.

Petronas has won the Calub and Hilala gasfield tender put up by the MME last

April. The gasfields are located some 1,200 km east of Addis Ababa. Officials of

Petronas and the Ministry have been negotiating on the gasfield development

project. The two parties are expected to sign petroleum development and

production sharing agreements in March. The agreements would enable Petronas to

extract the natural gas reserves in Calub and Hilala localities found in the

Ogaden basin. Petronas has also asked to be given Block 11 and 15 near the Calub

and Hilala gasfields. Officials of Petronas and MME have been negotiating on the

two blocks. "We have concluded talks on the acquisition of Block 11 and 15. We

could give the blocks to Petronas together with Calub and Hilala," Alemayehu

said.

Petronas has proposed to construct a gas processing plant and gas pipeline that

stretches from the gasfields to the port of Djibouti. The company also proposed

to drill additional wells in Calub and Hilala. So far ten wells in Calub and

four in Hilala were drilled. The gas reserve is estimated at 113.3 bn cm.

Petronas will conduct a seismic survey in block 11 and 15 and will drill

exploration well. The company has proposed to invest up to $ 1.9 bn for the gas

development project. Petronas would pay $ 75 mm pre-development cost that the

Ethiopian government spent on the Calub and Hilala gasfield.

Chinese oil firm to conduct seismic survey

Friday 12th May 2006

Chinese oil firm Zhongyuan Petroleum Exploration Bureau (ZPEB) is to start

seismic surveys in east Ethiopia's Ogaden basin next month. ZPEB and

Malaysian oil giant Petronas have agreed on the details of the petroleum

exploration project which is to be launched in the Ogaden basin next month.

ZPEB is contracted by Petronas, which was awarded blocks in the Fer Fer,

Warder and Genale regions of the Ogaden basin. The total area covers about

93,000 sq km.

ZPEB has been active in Ethiopia for some years. In 1998 it was contracted by

the Ethiopian government to make eight gas wells in Calub ready for production.

Geological data suggests that Ogaden and four other sedimentary basins in

Ethiopia are endowed with oil and natural gas. In March the Ministry of Mines

and Energy invited bidders to submit letters of interest in development of the

Hilal and Calub gas fields in Ogaden. The reserve in Calub, 1200km east of Addis

Ababa is estimated at 2.7 trillion cubic feet, while the reserve in Hilala, 75km

east of Calub, is estimated at 1.7 trillion cubic feet, which amount to a

combined total area of 285 square km. Interest was expressed by countries in the

Middle East, China, Russia and India.

Blood for oil in the Horn of Africa

On April 24, 2006, the

Ogaden National Liberation Front (ONLF), an ethnic Somalian

separatist group in eastern Ethiopia,

warned foreign oil companies against exploring for oil in their

homeland: "So long as the Somali people of Ogaden are denied

their basic rights to self-determination, the exploitation of

natural resources in Ogaden for the benefit of the Ethiopian

regime or any foreign firm will not be tolerated."

Exactly one year later,

the Financial Times is reporting that the ONLF has taken

credit for killing 65 Ethiopians and nine Chinese at an oil

exploration field in northern Ogaden.

The Chinese were employees of Zhongyuan Petroleum Exploration

Bureau, a subsidiary of the huge Chinese oil company Sinopec,

which had been

hired by the Malaysian oil company Petronas to explore for

oil and natural gas in Ogaden. But ZPEB is

far from the first foreign oil company to drill in eastern

Ethiopia.

In 1935,

reported Time Magazine, "Emperor Haile Selassie I made a

last desperate effort to forestall an Italian invasion by

offering to 'rent' as much as half of Ethiopia to a big U.S. or

British oil company." Ten years later Sinclair Oil nabbed a

50-year concession. Sinclair was followed by Tenneco Oil, which

discovered significant deposits of natural gas in Ogaden in

1974. But all the U.S. oil companies were kicked out by the

revolutionary Marxist regime of Mengistu Haile Mariam, who

replaced them with the Soviet Petroleum Exploration Expedition,

which drilled its own holes in the sedimentary basin of Ogaden.

Not uncoincidentally, the Soviets also provided

massive military assistance to Mengistu that enabled

Ethiopia to successfully win complete control of Ogaden from

Somalia.

Cold War power politics can be held at least partially

responsible for the ongoing anarchy, chaos and war that continue

to ravage the Horn of Africa and keep Somalia, Eritrea and

Ethiopia at each other's throats. But the Cold War is over, and

American and Soviet/Russian oil companies are long gone. Now

it's China's turn to get embroiled in the mess. For years, the

rebel activity in eastern Ethiopia between the ONLF and the

government has been described as a

"low-profile armed conflict." Not anymore.

-- Andrew Leonard

Source:

http://www.salon.com/

Ministry to Revoke SIL's Petroleum Development License

The Reporter (Addis Ababa)

January 14, 2006

Posted to the web January 16, 2006

The Ministry of Mines and Energy (MME) is to revoke the petroleum development

agreement it signed with the Jordanian company, SI- Tech International (SIL).

In 2003 the ministry granted SIL a license granting the company the right to

develop the natural gas reserves in the Calub and Hillala localities in the

Oganden basin. SIL had a plan to build a gas refinery plant, an electric power

station as well as a fertilizer and cement factories. The company previously

announced that it had allocated an initial capital investment of 1.5 billion

dollars.

The company was supposed to commence work on the first phase of the petroleum

project, the construction of the gas refinery plant, in July 2004. However, it

was unable to launch the project according to schedule. In November 2005, the

minister of MME, Alemayehu Tegenu, warned SIL that the ministry would revoke the

petroleum development license unless the company started work on the project

within 90 days. Officials of SIL said they were unable to launch the

construction because of the inflated price of steel and the poor condition of

the road to the gas fields. Minister Alemayehu however, said the explanation

given by the officials was unacceptable.

The 90-day ultimatum will come to an end by next month. The ministry told The

Reporter that since the company failed to operationalize the project it would

nullify the petroleum development license.

The gas fields are located 1200 kms east of Addis Ababa. The gas reserve in

Calub, which was discovered in 1973, is estimated to be 76 billion Cu.m. The

reserve was discovered by Tenneco, an American oil company. The second gas

reserve found in Hillala locality is estimated to be 42 billion cu.m The Hillala

gas reserve was discovered by a Russian company, Soviet Petroleum Exploration

Expedition (SPEE).

SIL to

invest 1.5 billion USD in the mining industry

"At last we made it!" Mohammed Dirir

http://www.capitalethiopia.com/archive/2004/jan/week1

By Tamiru Geda

Many people including government officials were fed up with the frequent

interruptions in negotiations for the exploration of natural gas, in the last

three decades.

Lately however, things seem to be looking up for natural gas exploration, thanks

to some committed petroleum companies which have shown keen interest in joining

the Ethiopian government, particularly the Ministry of Mines in investing and

exploring the natural gas fields of the nation.

Ambassador Mohamed Dirir said that the Minister of Mines is one of many

Ethiopians eager to see this resource available and ready for consumption. He

made the statement at the signing ceremony of the Petroleum Development and

Production Agreement, in the Hilton Addis with the Middle East based company, Si

Tech International (SIL).

Minister Mohamed expressed his happiness on the occasion. Using the same tone

that the American administrator of Iraq used after the capture of Saddam

Hussein, the Minister declared, "Ladies and gentlemen, at last we made it!" to

the cheers of delegates from government offices and representatives of SIL.

Ziad I.Kh Mango, Chairman of SIL was present to sign the agreement with the

Ministry of Mines for exploration of the Hilala gas reserves in the desert area

of the Somalia Regional State of Ethiopia.

His company, he said, is committed to invest in Ethiopia and expressed regret

that they did not do it earlier. "We are here for good and to invest USD 1.5

Billion to develop the 280 square kilometers of gas reserves in Calub and

Hillala area." Zaid also promised to work with the Ministry of Mines as a

partner.

According to the company"s work plan, it will install a GTL plant in Dire-Dawa,

with a capacity of producing 34 thousand barrels of petrol per day. It will also

produce 20 million barrels of liquid petroleum such as benzene, Kerosene and

diesel by using gas processing technology at Calub, within the next two years.

Calub to be given to private campanies on concession

By Kaleyesus Bekele

The Ministry of Mines told the Reporter last week that it was read to give the

Calub gas field to private companies on concession.

Since the effort to privatize the Calub S.C. could not be successful, it was

decided to give the gas field to private companies on concession, it was learnt.

The Ministry said it was ready to negotiate with any company which had the

know-how and the financial capacity to exploit the Calub natural gas reserve

estimated at 76 billion cu.m.

Though officials of both the Ministry of Mines and the Calub Gas S.C had held

talks with several foreign oil and gas companies to jointly develop the reserve,

their effort could not bear fruit.

Methanol and STROYTRAN GAZ, the Russian oil and gas companies, signed last week

a Memorandum of Understanding with the Ministry to develop the reserve. However,

the companies could not sign the final agreement since they did not have the

finacical resources to implement the project.

According to the Ministry, the companies came up with only the technology and

asked the government to solicit funds from the international financial

institutions. Two month ago the Ministry proposed to Prime Minister Meles Zenawi

to dissolve the Calub Gas S.C. However, Meles did not as yet approve the

proposal.

The Calub natural gas reserve was discoverd in 1973 and nine wells are ready to

go into production.

Russians sign for 50 percent shares in Calub

ADDIS ABABA, February 04, 2002-- A Russian oil company, Methanol, has signed

a memorandum of understanding both with the Ministry of Mines and Calub Gas

Share Company to own 50 percent shares in Calub Gas, while it commits itself to

invest 80 to100 million USD during the initial phase.

Top executive of Calub Gas told the English weekly Fortune that the memorandum

of understanding (MOU) requires both parties to jointly develop gas fields on

the 76 billion cubic meters natural gas reserve, located 1200 kms south east of

Addis Ababa in the Somali State.

Sinknesh Ejigu State Minister of Mines and Hialemelekot Teklegiorgis Board

Chairman of Calub and State Minister of Defense signed the agreement with the

director of Methanol.

Jihad Abakoyas General Manger of Calub told Fortune that the Russian company had

agreed to form a joint venture share company owning 50 percent shares to exploit

the gas reserves.

The General Manager revealed that the plan to develop the fields involves the

construction of four refinery and petroleum extraction plants within the Calub

area, with an investment reaching about 500 million USD.

The first phase of the project consists of building the first gas refinery

plant.

Jihad revealed that the investment by the Russian company would increase through

time depending on the results obtained from the first phase of the project.

He added that knowledge and technology transfers in executing the project would

be vital.

In a similar development, another five-member Russian team representing Story

Trans Gas Share Company, an oil and gas company has arrived in Addis Ababa and

begun negotiations with the Ministry of Mines to engage in oil and gas

explorations and development in Ethiopia.

According to Jihad, Story Trans is interested in exploration of petroleum in the

Ogden basin and Gambela region. He said that the company's representatives were

planning to fly to these areas for a site visit.

The delegation is currently conducting preliminary studies and is collecting

date, reports and other relevant information about the basins. Story Trans is

also interested in Calub Gas and holding talks with the officials. - Fortune

World Bank Leaves Off Extending Loans to

Calub

August 19 - 26, 2001 BY

KALEYESUS BEKELE; FORTUNE STAFF WRITER

The World Bank has reportedly suspended releasing the loan it had

pledged to extend to Calub Gas S.C. demanding the government to

privatize the 95pc share it owns in the company to continue financing

the project in return. According to our sources, the bank decided to

refrain from disbursing the loan at the beginning of the current fiscal

year. An initial survey conducted by the World Bank puts the Calub Gas

project cost at 85.96 million Dollars of which it has committed to

finance 66.31 million Dollars while the remaining is to be made up from

local sources. Following the agreement with the Ethiopian government on

June 23, 1994, the bank commenced to outlay some portion of the agreed

loan and construction was launched in September 1995.

The standard of the loan is in International Development Association

(IDA) terms with a maturity of 40 years and three years grace period.

Fortune learnt that the bank's abrupt action to withhold the remaining

amount of the loan is in a bid to pressing the government to speed up

the privatization process of the share company to be entirely controlled

by private entities. World Bank officials have declined to comment on

the issue, while the general manager of Calub, said to be out of town,

could not be available for comment. A minority share of only five per

cent in the company is currently in the hands of private businesses and

individuals, who have invested 102 million Br in aggregate. The renowned

coffee exporter, Mohamed Oksedeh, is in the list of shareholders having

stakes worth 200,000 Br in the company

The Ethiopian Privatization Agency had put Calub Gas S.C. on tender two

years ago but attempts to privatize the company failed to materialize.

An official in the privatization agency told Fortune that the bid was

thwarted because of low values offered by the prospective buyers,

questioning the accuracy of the amount of gas deposits declared to be

available for exploitation, estimated to reach 76 billion cubic meters.

According to sources, those who have shown interest in Calub say the

quantity of gas deposits, unlike other minerals such as gold, can not

specifically be predetermined. Information obtained from the agency

indicates four companies, Sheik Al-Amoudi's investment arm- Midroc,

Santafe, Matle and Norex Group, participated in the bid. The bidders

also came up with a pre-condition requesting a guarantee from the

government that ensures all the towns in the eastern part of Ethiopia,

including Dire Dawa and Harrar, would use electric power generated

utilizing gas produced by Calub. Another reason given for the delay of

the privatization process, according to the official who said he is

unaware of the bank's decision to suspend the loan, is the memorandum of

understanding signed between Calub and an American Company. The agency

official also said that the shareholders of Calub that own the five per

cent share have also objected to the tender saying that they were not

informed about it prior to the privatization process.

After the cancellation of the first bid, the agency has not shown sign

until now to issue a re-tender. The information officer at the agency

said that Calub is not included in the list of enterprises that are on

the auction block to be privatized in the short run. An American

company, Cal Tech International Corp, and China National Petroleum

Corporation, a Chinese company, have recently shown interest in Calub

Gas S.C. for a joint venture development of natural gas. However,

tangible results have not so far evolved.

The Calub Gas Project, which is thought to be a cash-cow business,

comprises three components: a commercial part consisting of preparation

and completion of the gas wells, construction and operation of the

petroleum extraction and processing plant and privatization promotion; a

regional development scheme for Ethiopians in the south eastern region;

and technical assistance to the Ministry of Mining and Energy. The

designing work of the refinery and the preparation of bid documents to

hire a contractor for building the facility were carried out by a

British firm and submitted to the World Bank, which was evaluating them

until recently. The preparation of eight production wells for

exploitation have been carried out and completed by a Chinese firm

contracted for five million Dollars.

Sources close to the project say that the cost to launch a full-scale

production, including a Urea fertilizer factory related to gas

production and revised project of constructing a pipeline extending

700kms to channel gas from the production wells to Awash, where the

refinery is planned to be erected, could escalate to the neighborhoods

of 1.5 billion Dollars. Fortune learned that so far 96 million Dollars

have been invested in the Ogaden basin. The Ogaden Basin exploration

history dates back to 1920 pioneered by Standard Oil Company that first

carried out a geologic survey. Since then 14 companies had taken

concession and conducted exploration surveys and mapping. Tenneco, an

American company at a depth of 3732 meters, discovered natural gas in

1972. Although 29 years have elapsed since gas was first discovered in

Ethiopia, the country, in a rueful turnout, has not been capable to see

the fruits of the discovery to date.

American Company Contemplates Calub Gas

Exploitation

BY

MIKIAS WORKU FORTUNE STAFF WRITER

An American company, which was

contemplating to invest in power generating projects negotiating with

EEPCo last year, has now shown interest in Calub Gas S.C. for a joint

venture development of natural gas, although concrete results have not

yet materialized. Representatives of Cal Tech International Corp., who

were here a month ago, were briefed by officials of Calub Gas on the

existing potentials and were provided with strategic data and

information on the project.

Sources said that the company was requested to produce the necessary

documents, which include the company's base of registration and legal

status, funding, track records of the past three or four years, that

should all be authenticated by the U.S. government, to start negotiation

for concluding a deal. According to our sources, the company has

verbally pledged to finance the construction of the pipeline that would

be used to carry crude gas from the gas field to the central processing

plant and refinery, which is intended to be erected at Awash,

approximately 700Kms from the production wells.

The designing work of the refinery and the preparation of bid documents

to hire a contractor for building the facility were carried out by a

British firm and submitted to the World Bank, which was evaluating them

until recently. Though Cal Tech had promised to come back in two weeks

with the required documents, sources said it is now a month and there is

no sign of its coming back. This same company had written a letter of

intent last year to invest more than 300 million Dollars in power

generation, but it is unknown where the negotiations with EEPCo

presently stand.

Discovered in 1972, the Calub natural gas resource is estimated to reach

76 billion cubic meters and currently eight production wells stand ready

for exploitation after being prepared and tested by a Chinese company,

which was contracted for 5.6 million Dollars to undertake the job

winning a tender in 1996. The company completed preparing the gas wells

for production in late last year. Sources close to the project say that

the cost to launch a full-scale production, including a UREA fertilizer

factory related to gas production, could reach a level of 1.5 billion

Dollars.

Africa "Key Source" for Energy Supply and

Development Senior U.S. energy official testifies before Congress- March 16 2000??;

Africa is a "key source" of diverse energy

for the United States and will likely become the next important emerging

market in trade and investment, energy resources, and energy

consumption, a senior U.S. energy official told the U.S. Congress March

16.

In testimony before the Subcommittee on Africa in the House of

Representatives, Calvin R. Humphrey, principal deputy assistant

secretary for international affairs at the Department of Energy, also

reminded lawmakers that Africa is the third largest oil exporter to the

United States and plays an "integral role in U.S. efforts to maintain a

diversified oil import base."

Humphrey chronicled a wide range of U.S. investment in Africa's energy

sector, which includes:

-- Chevron's participation as the managing partner for the West African

gas pipeline, which is designed to connect Nigeria's gas reserves to

markets in Benin, Togo, and Ghana;

-- Exxon-Mobil's efforts in leading the development of the Chad Export

Project (CEP), a proposed $3,500 million project to produce and

transport 250,000 barrels of oil per day from southern Chad through

Cameroon for export to world markets, including the U.S.;

-- Dallas-based Triton Energy's allocation of $191 million to invest in

the development of the Ceiba Field and continued exploration and

appraisal activity in Equatorial Guinea;

-- the U.S. firm Sicor and Ethiopia's announcement that they have signed

a $1,400 million joint venture to develop a huge gas field in the east

of the country and build a pipeline and processing units;

-- the signing by Enron, an oil and gas firm in Houston, of a power

purchase agreement to supply emergency electricity to state-owned power

utility Nigerian Electric Power Authority (NEPA) through 30-megawatt

power barges located on the coast of Lagos State.

Sicor plans 375-mi Ethiopian line

January 2000 Vol. 83 No. 1

Construction Report

Sicor, Inc., and the Ethiopian government

have signed a memorandum of understanding to build a 375-mi, 24-in.

natural gas pipeline in Ethiopia.

The $300-million pipeline would be part of the $14-billion Gazoil

Ethiopia project to develop synthetic fuels using gas-to-liquids (GTL)

technology.

The line would transport natural gas and associated fluids from the

Calub and Hilala fields in southeast Ethiopia to Awash. There, a planned

cryogenic liquids plant and a refinery will convert the gas and liquids

into commercial fuels using GTL technology.

Sicor plans to commence a 12-month pre-development phase in February

2000, involving feasibility, route, and market-demand studies.

The company plans to award an $800-million construction contract for the

pipeline and plant in late March 2000.

Construction could start in late March 2001 for a September 2002

in-service.

Small firm signs $1.4 billion deal to

develop gas project in Ethiopia

December 20 1999

Houston Business Journal

Monica Perin A small, privately held Houston company

has struck a deal on a $1.4 billion energy privatization project in

Ethiopia.

Sicor Inc. and the Federal Democratic Republic of Ethiopia have signed

an agreement to form a joint venture, the Gazoil Ethiopia Project, which

will build a 375-mile natural gas pipeline and a series of processing

plants.

Sicor will hold an 80 percent stake in the joint venture, and the

Ethiopian government, 20 percent.

Sicor is a six-month-old corporation -- 70 percent of which is owned by

Chairman Ronnie F. Monk.

Monk formed Sicor from Cogen International Management, a partnership

that was in the business of assembling and predeveloping pipeline and

power projects.

Sources familiar with the negotiations say Sicor's primary competitor in

the bidding was Houston-based Santa Fe Snyder Energy Co.

The project is expected to have a major impact on Ethiopia, an

agricultural country that still uses wood for fuel, causing massive

deforestation and land erosion.

In addition to providing liquid propane gas, electricity, water and

fertilizers for domestic use, the project will generate other fuel

products for export, which would greatly improve Ethiopia's foreign

exchange position. The country will become a net exporter of fertilizers

for the first time, a government spokesman said.

Under terms of the agreement, the Gazoil Ethiopia Project will acquire

two concessions in the Ogaden basin in southern Ethiopia where four

trillion cubic feet of gas and 13.6 million barrels of associated

liquids were discovered by Tenneco in the 1970s.

The joint venture will also acquire 95 percent of the Calub Gas Share

Co. from Ethiopia under privatization laws. The joint venture will pay

the Ethiopian government $111 million for the gas company, which has

carried out all the exploration and development work in the project area

to date. Under the new name Gazoil Ethiopia Share Company, it will be

expanded to take over all production work for the project.

The pipeline will transmit gas and other liquids to the town of Awash,

75 miles east of the capital city, Addis Ababa. At Awash plans call for

construction of a cryogenic liquids plant and two gas-to-liquids process

systems with capacity to process 200 million cubic feet of natural gas

per day. The end products will be synthetic fuels and petrochemical

feedstocks plus steam that will generate electricity and potable water.

A planned refinery will produce products including diesel, gasoline,

kerosene and jet fuels. The gas-to-liquids system will also produce some

500 tons of ammonia per day as feedstock for a urea plant to be

constructed.

Sicor will begin the pre-development phase of the project in late

February, says Monk. It is expected to be completely on stream by Sept.

1, 2002.

Monk's previous partnership did pre-development studies for the Attacama

Project in South America, a 450-mile pipeline from Argentina over the

Andes Mountains to northern Chile. The project was ultimately sold to

CMS Energy in Michigan.

Now, Monk says, Sicor is doing strictly gas-to-liquids projects which

the company develops and owns. Sicor operates only in the Arabian Gulf

and sub-Sahara Africa, where it has six other projects under

consideration. Monk says he expects to sign an agreement on a project in

Yemen after the first of the year.

source:

http://www.amcity.com/houston/stories/1999/12/20/story5.html

Ethiopia Signs $1.4 Billion Deal With U.S.

Firm Sicor

Reuters; December 9, 1999 ADDIS ABABA (Reuters) - Ethiopia said on

Wednesday it had signed a $1.4 billion joint venture deal with U.S. firm

Sicor to develop a huge gas field in the east of the country and build a

pipeline and processing units.

The joint venture, Gasoil Ethiopia Project (GEP), will develop fields in

the Ogaden basin where four trillion cubic feet of gas and 13.6 million

barrels of associated liquids were discovered in the 1970s, government

spokesman Haile Kiros told Reuters.

The Ethiopian government will hold a 20 percent stake in the joint

venture and Sicor, based in Houston, Texas, the remainder.

Details of financing were not given. GEP plans to construct a 375-mile,

24-inch gas pipeline to transmit gas to the town of Awash, around 75

miles east of the capital Addis Ababa, on the country's main railway

line and highway.

Haile said the joint venture will construct a cryogenic liquid plant to

strip mostly liquefied petroleum gas (propane and butane) and condensate

from the gas, as well as two gas-to-liquid systems to process dry gas.

The plant would process a total of two billion cubic feet of gas a day

into 20,000 bpd of fuel and petrochemical feedstocks. Waste steam would

fuel a 168 megawatt power plant, he said.

The joint venture is expected to start 12 months of pre-development work

in February with production slated to start in 2002.

Haile said the agreement was hugely important for Ethiopia, where the

felling of trees for fuel has caused major deforestation.

The ammonia by-product from gas processing would make Ethiopia a net

exporter of fertilizers for the first time, Haile said.

A Second Wind For Calub Gas

The International Oil & Gas Newspaper

UPSTREAM

Vol 4, Week 5, 5th February 1999 Barry Morgan from ACCRA

Interest is slowly reviving in Ethiopia�s

Calub gas project after the country's Privatization Agency previously

dashed hopes by withdrawing four bids submitted for the development of

the onshore field, which contains an estimated 2.71 trillion cubic feet.

One of the four, Santa Fe Energy has renewed contract with the energy

ministry, a department source said.

The principal reasons for refusing the bids from Santa Fe, Mapple,

Knorex and Midroc was their "failure to fully comply with requirements"

enabling the government to recover the $97 million it invested in

phase-1 of Calub, located on block OG-1.

Two companies from the Middle East and the US have also shown interest

and the agency "is now ready to accept new and revised offers", the

source said. "Whether we accept the recovery of less than the full

project cost will depend on the investment plan submitted."

The World Bank has earmarked an additional $74 million for the project,

which aims to convert gas from the Ogaden basin into power, fertilizers

and sundry industrial feedstock for export. The ministry also wants to

explore the Hilale find some 80-km northwest of Calub. Volume 3, issue

#2 - Tuesday, February 02, 1999

Ethiopia withdraws bid for sale of gas company

20-12-98 The Ministry of Mines and Energy of Ethiopia announced the

government's decision to reject the bid for the privatisation of the Kalub

Gas Share Company.

The Ministry said that the Ethiopian government has decided to withdraw

the bid for the sale of its stake in the company because it found the

bid results unsatisfactory.

The Ministry said the prices quoted and the terms stated by the bidders

who include four international companies are not commensurate with those

stipulated in the bid document.

The Ethiopian Privatisation Agency invited bids earlier this year for

selling off the government's stake in the company. Four international

companies including an American company have bidden for the

competition. However, the prices gave by the four companies were

unsatisfactory to the Ethiopian government.

The Kalub Gas Share Company, established in accordance with the

Ethiopian law, aims at tapping the natural gas resources found in

the Ogaden area.

According to the Ministry, a study hasconfirmed the availability in

the area locally known as Kalub of 68 bn cm of natural gas and a loan of

over $ 74 mm has been obtained from the World Bank for the natural gas

project.

The Ministry said, the Ethiopian Privatisation Agency has been taking

measures to sell off government's stake in the company, but added that

now the company will continue in its present entity.

Inventory of fossil fuel extraction

projects financed by World Bank Group,

mid-1992 to 1997 ETHIOPIA

Type of Industry:

Natural gas field development

Subsidized Project:

Calub gas development

Location:

Calub natural gas deposit, Ogaden Basin, Ethiopia

Owner of Project:

Calub Gas Share Company (state-run)

G-7 TNC Involvement:

Parsons Corp. (U.S., awarded $50 million contract for construction of

gas processing plant)

World Bank Agency:

IDA

Amount of Financing (estimated total cost):

$74.3 million of $130.8 million, with cofinancing from African

Development Bank ($27 million) and the Netherlands ($4 million).

Year of Approval:

FY1994

Reserves/Production:

Calub holds an estimated 74 billion cubic meters (2.6 TCF) of natural

gas deposits.

World Bank Description:

"By increasing the availability of fuel from the Calub natural gas

deposit in the country's southeast region, Ethiopia's unbalanced

structure of energy supply will be partially righted and the supply of

petroleum products needed in the modern sectors of the economy

increased. Road rehabilitation, technical assistance, and a

poverty-alleviation component -- aimed at supporting income

diversification among poor urban fuelwood carriers --is included."

(World Bank Annual Report FY 1994)

Notes:

This is Ethiopia's first natural gas field development. Construction is

to start in 1997 and be completed in 1998. Parsons called the project

"a starting point for Ethiopia's long-term development of fossil-fuel

resources." (Business Wire, Feb. 6, 1996; Xinhua, Feb. 23, 1997; Oil

& Gas Journal, Feb. 12, 1996; Africa News, Feb. 26, 1997;

ESP-Business Opportunities in Africa & the Middle East April 1,

1996)

Source:

http://www.seen.org/wbreport1/extraction.en.html

:::OGADEN BASIN HYDROCARBON PROSPECTIVITY

:::TAARIIKHDA SHIDAALKA OGAADENIYA |

Though

there are five sedimentary basins believed to be prospective for oil discovery

in Ethiopia, much of the oil exploration activities hitherto have been carried

out in the Ogaden basin, eastern part of the country. The Ogaden, Gambella, Omo

Valley, Abay Gorge and Mekelle are the five sedimentary basins found in

Ethiopia.

Though

there are five sedimentary basins believed to be prospective for oil discovery

in Ethiopia, much of the oil exploration activities hitherto have been carried

out in the Ogaden basin, eastern part of the country. The Ogaden, Gambella, Omo

Valley, Abay Gorge and Mekelle are the five sedimentary basins found in

Ethiopia.