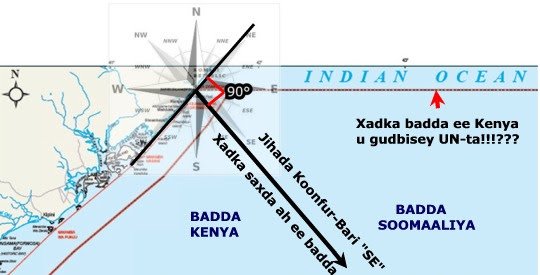

Waxaan Ummadda Somaaliyeed la socodsiinayaa in aaysan jirin qof ka hadlaya howsha ka socota Block L13 oo aay Kenya rabto in aay Shiidaal iyo Gaas ka qodato.

Block L13 waa qeeb ka mid ah Dhulbadeed Soomaaliyeed ee biyaha RASKAMBOONI.

Waxaa la yaab leh in aaysan Ummadda Soomaaliyeed ku baraarugsaneen SHIIDAALKOODA oo Kenya iyo Shirkadaha shisheeye aay boobayaan oo har iyo habeen ku mashquulsanyihiin in aay shiidaalka kala soo baxaan. Shikadahaas oo kala ah:- Block L5 (Anadarko), Block L22 (Total), Block L21, L23, L24 (ENI), Block L13 (Zarara Oil) iyo Block L26 iyo Block L25 oo (Beec hadda u taagan).

Block L13 (Zarara Oil)Waa qeeb ka mid ah dhulbadeedka Soomaaliyeed oo hadda aay Kenya ku mashquulsantahay si aay shiidaal iyo GAAS ugala soo bahdo.

Cabirka dhulbadeedkaasi (Block L13) waxuu dhanyahay qiyaastii cabir u dhigma Muqdisho ilaa Afgooye iyo Balcad oo(Angolka) Xagashu aay furan tahay 45° (45 degree elbow center).

Waa dhul badeed aad u baaxadweyn, horayna waa uga hadlay oo qoraalladeydii hore ayeey ku jiraan.

Ummadda Soomaaliyeed ha u gurmadeen sidii aay u difaaci lahayeen Batroolka Soomaaliyeed oo la boobayo.

Bashir Shekh Moxamed

bashirmohamud@yahoo.com

Halkan hoose ka arag sida loo dadajinayo Howsha Block L13. iyo qolada maalgalineysa:-Oil & Gas Industry – Al Braik Investments LLC .Al Braik Investments – Real Estate | Al Braik Investments LLC

Update – Swiss Oil Takes Kenyan Blocks L4 and L13

Further to Petroleum Africa’s exclusive report on September 3 regarding Swiss Oil’s signing of two production sharing contracts (PSCs) with Kenyan authorities, Bill Brumbaugh, Operations Director for Swiss Oil, provided a further update on the project.

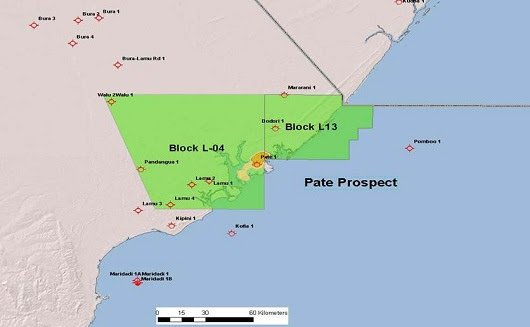

“On Wednesday, September 3, 2008 the Kenya Minister of Energy, Mr. Kiraitu Murungi, and SOHI Oil & Gas Ltd. signed Production Sharing Contracts covering Blocks L4 and L13. These blocks cover some 10,000 sq km on the northern Kenya coast and contain several historical wells with both oil and gas shows.

“In addition, the Pate-1 well in Block L4 is a significant legacy gas discovery. In the coming months SOHI Oil & Gas Ltd. intends to initiate work leading to both evaluation of the hydrocarbon potential of these blocks and to assess the potential commercial production into the Kenya market of the Pate legacy discovery. If successful, Kenya’s first commercial hydrocarbon production could come from these blocks.”

The overall aim of the project is to develop coastal natural gas on trend with a 1970s legacy discovery and to establish a domestic hydrocarbons-to-power market for Kenya.

The L4 and L13 blocks measure 7,509 sq km and 2,905 sq km respectively. Both blocks are coastal just south of Somalia in the Lamu Basin.

Swiss Oil was founded by Loma Energy, Inc. and New Exploration Ventures Sole Proprietary on a 50/50 basis. The company is currently evaluating and/or applying for opportunities in North, West, and East Africa and has initiated bids, signed technical agreements, and entered into negotiations with local authorities.

//////////////////////////////////

Media Release

MIDWAY RESOURCES INTERNATIONAL

http://www.midwayresources.com

MIDWAY RESOURCES INTERNATIONAL (“MRI”) completes gravity-magnetic seismic data acquisition programs on Blocks L13 and L4, Kenya.

MRI, through its wholly owned subsidiary Zarara Oil & Gas Limited, holds a 75% working interest and operatorship of PSCs for Blocks L4 & L13, Kenya, now in their 1st Additional Exploration Period of 3 years. The Blocks cover 7,446kms2of the coastal region of Kenya, north of Lamu Island and straddle the Lamu geologic basin. The L4 Block contains the Pate-1 gas discovery well (drilled by Shell, 1971), hereafter designated as the ‘Pate Prospect’.

Completion of Pate Island Prospect 2D Transitional Seismic Survey

MRI has now completed its 383 line kms 2D survey over the Pate Prospect. The survey covered Pate Island and surrounding transitional mangrove and sea channel areas and was undertaken by BGP Kenya Limited.

Seismic data are being processed by Geokinetics, Inc., of Houston USA and interpreted by MRI. Approximately 40% of the data has been processed and interpreted to date, with the balance anticipated to be completed over the next quarter.

Sufficient data has been interpreted to enable MRI to identify the location of a drilling site (Pate-2) which will replicate the original discovery well (Pate-1). Pate- 1 intersected and flowed (uncontrolled) gas and was subsequently plugged and abandoned. MRI will commence planning for Pate-2 in the next quarter which process could take up to 12 months before the well is spudded.

Depending on Ministry of Energy approval, MRI’s intention is to complete Pate-2 as a producing well which will undergo extended well testing to supply temporary electric power generating units. These could supply electricity to the local extension of the Kenyan national grid. Assuming that Pate-2 confirms MRI’s current P50 resource estimate, this early gas production would represent Phase 1 of a full-field development to be based upon long term commericalisation of the gas resources. Phase 2 would involve development of a 350-500MW power station connected to the Kenyan domestic electricity grid. The grid is currently being extended to the proposed new Lamu Port, located some 15-20kms from the site of the original Pate-1 well.

Block L4 & L13 – exploration activities

Gravity-Magnetic survey: MRI has completed the acquisition, processing and interpretation of 6,262 line kms of gravity-magnetic data across the original area of its operated Blocks L4 and L13.

The survey was flown by New Resolution Geophysics, based in South Africa, using a 2km flight line separation with 10km north – south tie lines.

Analysis of the survey data has identified nine additional anomalies or leads on Blocks L4 & L13 which will be followed-up by an additional seismic survey programme to be executed by MRI over the next 24 months.

The Pate-2 well and regional seismic acquisition survey will be funded through a combination of additional equity and a possible partial farm-out of MRI’s 75% working interest. MRI is now actively pursuing such funding.

For more details you are referred to the MRI website: http://www.midwayresources.com

History:

Midway Resources International was founded in 2005 by Dr. Mark Bristow, its chairman. Its strategy is to secure relatively lower risk discovered, but undeveloped, oil and gas resources across Africa, and to rapidly develop and commercialise them.

It acquired its interests in Zarara Oil & Gas Limited in quarter 2, 2012, and following extensive negotiations with the Kenyan Government regularised its PSCs by advancing into the 1st Additional Exploration Period of 3 years ending December, 2015.

MRI’s other current focus area is Nigeria, where it is pursuing a material and attractive shallow offshore undeveloped discovery. It already has an existing Nigerian investment, via its 20% shareholding in Inergia Petroleum Limited, in the Oza (in development with production expected quarter 1, 2014) and Atala (awaiting appraisal) fields, onshore Nigeria.

For further information contact:

CEO Peter Worthington – Mobile: +44 7710 680826

CFO Patrick Barr – Mobile: +44 7788 920915

info@mrimc.com

Telephone: +44 20 79457072

Operations

Midway Resources International:

Kenya MRI owns a 75% working interest and operatorship (via its 100% subsidiary, Zarara Oil & Gas Limited) in two production sharing contracts over Blocks L4 and L13, Kenya, an area of some 10,000kms2, currently one of the most sought after areas in the global upstream oil and gas industry.

Waa ka xumahay in som iyada is layso dhexdeeda.marka inta somalimo rabtaa in ay llacag u ruuriyaan oo somalida aqoonta leh iyo khareen of loyer Loo qabato maxkamada iyo dagaanbiedingen la qadaa. Berlamaanka soomaliyeed Loo sheegto waxa jira

Shaqada ka socoya Block L13 iyo faaiido qeybsiga-(production sharing).

Home – Midway Resources International

Operations

Kenya MRI owns a 75% working interest and operatorship (via its 100% subsidiary, Zarara Oil & Gas Limited) in two production sharing contracts over Blocks L4 and L13, Kenya, an area of some 10,000kms2, currently one of the most sought after areas in the global upstream oil and gas industry.