NEWS RELEASE

FEB 4, 2009 - 18:21 ET

PDF

Version: Click here...

Africa Oil Acquires Major East African Oil

Exploration Portfolio

CAD $20 Million Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Feb. 4, 2009) - Africa Oil Corp.

("Africa Oil" or "the Company") (TSX VENTURE:AOI) is pleased to announce that it

has signed a Share Purchase Agreement to acquire a large portfolio of East

African oil exploration projects from Lundin Petroleum AB. The projects are

located within a vastly underexplored region of the rich East African rift basin

petroleum system. The projects acquired include an 85% working interest in

Blocks 2, 6, 7 and 8 and a 50% working interest in the Adigala Block in Ethiopia

plus a 100% interest in Block 10A and a 30% interest in Block 9 in Kenya. Africa

Oil will assume operatorship of these projects excluding Block 9 in Kenya.

This new acreage is complementary to and consolidates Africa Oil's existing

holdings in what is considered a truly world-class exploration play fairway.

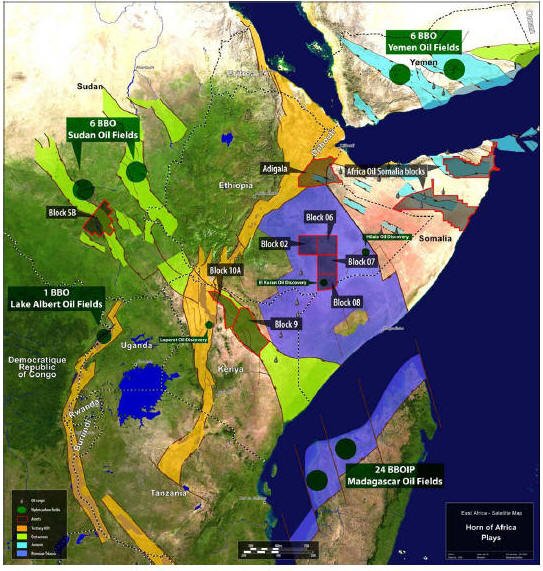

Upon conclusion of the transaction, the Company's total land package in this

prolific region will be in excess of 200,000 square kilometers - an area roughly

the size of Great Britain. To see attached map, please click on the following

link:

http://media3.marketwire.com/docs/AOI0204.jpg.

http://media3.marketwire.com/docs/AOI0204.jpg

The East African Rift Basin system is one of the last of the great rift

basins to be explored. New discoveries have been announced on all sides of

Africa Oil's virtually unexplored land position including the major Heritage/Tullow

1 billion+ barrel Albert Graben discovery in neighbouring Uganda. Similar to the

Albert Graben play model, Africa Oil's concessions have older wells, a legacy

database, and host numerous oil seeps indicating a proven petroleum system. Good

quality existing seismic show robust leads and prospects throughout Africa Oil's

project areas.

Exploration activity is now starting to pick up in the area, however, less than

200 wells to date have been drilled over the years in Ethiopia, Kenya and

Somalia's hydrocarbon basins which encompass an area greater than 2.3 million

square kilometers. For scale of reference, the North Sea basin encompasses

210,000 square kilometers and has seen over 4,600 wells (61 wells drilled before

commercial oil). The North Sea reserve estimates are approximately 50 billion

barrels of oil equivalent and current production is approximately 5.5 million

barrels of oil equivalent per day. The Gulf of Suez has over 3,096 wells drilled

within an area of 26,000 square kilometers. Reserves here are estimated at 8

billion barrels with production currently estimated at 700,000 barrels of oil

per day.

Africa Oil has an aggressive exploration program planned over the next two years

which will include seismic and drilling in both Ethiopia and Kenya, in addition

to the previously announced upcoming drill program in Puntland, Somalia.

Rick Schmitt, President of Africa Oil, commented, "Through this transaction,

Africa Oil has secured a major East African acreage position in all key

petroleum systems which extend into the area. The Production Sharing Agreements

provide excellent fiscal terms for exploration and development. The Company has

identified numerous large and robust prospects on seismic and we look forward to

the opportunity of exploring within a truly world class exploration play

fairway."

Pursuant to the Share Purchase Agreement, Africa Oil will pay as consideration

to Lundin Petroleum AB approximately US $20 million which will be funded through

a convertible loan from Lundin Petroleum AB maturing December 31, 2011 and at an

interest rate of USD six-month LIBOR plus 3%. The loan, including any accrued

and unpaid interest, will be convertible, at the option of either Africa Oil or

Lundin Petroleum AB, into shares of Africa Oil on the basis of CAD $0.90 per

common share.

The Company's existing CAD $6 million loan (plus accrued interest) from a

shareholder of the Company will be converted to Units of the Company on the

basis of CAD $1.00 per Unit. Each Unit will comprise one common share and

one-half of a share purchase warrant. Each whole warrant is exercisable into one

common share of Africa Oil at a price of $1.50 per share over a period of two

years. In the event that Africa Oil trades at or above CAD $2.00 for a period of

30 consecutive days, a forced exercise provision will come into effect.

Concurrent with the Share Purchase Agreement, Africa Oil has agreed to sell, on

a non-brokered, private placement basis, an aggregate of up to 20 million Units

of the Company at a price of CAD $1.00 per Unit for gross proceeds of CAD $20

million. Each Unit will comprise one common share and one-half of a share

purchase warrant. Each whole warrant is exercisable into one common share of

Africa Oil at a price of $1.50 per share over a period of two years. In the

event that Africa Oil trades at or above CAD $2.00 for a period of 30

consecutive days, a forced exercise provision will come into effect. A 5%

finder's fee may be payable on all or a portion of the private placement. Net

proceeds of the private placement will be used towards the planned work programs

on the Company's projects in Ethiopia, Kenya and Somalia, as well as for general

corporate purposes. The private placement is subject to regulatory approval.

The foregoing transactions are subject to all requisite regulatory and

government approvals, as well as shareholder approval if required.

ON BEHALF OF THE BOARD

Rick Schmitt, President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Africa Oil Corp.

Sophia Shane

Corporate Development

(604) 689-7842

(604) 689-4250 (FAX)

Email: africaoilcorp@namdo.com

Website:

www.africaoilcorp.com

IMAGE: See here...

Also, PDF Version:

Click here...

5 February 2009

LUNDIN PETROLEUM TO SELL ITS EAST AFRICAN INTERESTS

Lundin Petroleum AB ("Lundin Petroleum") is pleased to announce the signing of

an agreement for the sale of its wholly owned subsidiaries, Lundin East Africa

BV ("Lundin East Africa") and Lundin Kenya BV ("Lundin Kenya"), to Africa Oil

Corporation ("Africa Oil").

Lundin East Africa holds Lundin Petroleum's interests in and operatorship of

production sharing contracts (PSCs) covering Blocks 2, 6, 7 and 8 in the Ogaden

Basin region in the south of the Federal Republic of Ethiopia ("Ethiopia") and

covering the Adigala Area in northern Ethiopia. Lundin Kenya holds Lundin

Petroleum's operated interest in the PSC for Block 10A and its non-operated

interest in the PSC for Block 9 in the Anza Basin region in the northwest of the

Republic of Kenya. The Africa Oil transaction also includes the transfer of an

option which Lundin Petroleum holds over Blocks 35 and M10-A in the Somalia

Democratic Republic, currently in force majeure.

Africa Oil is a Canadian oil and gas company with exploration interests in East

Africa. Africa Oil's shares are listed on the Toronto Stock Exchange (Venture)

under the symbol "AOI". Africa Oil is headquartered in Vancouver, Canada and one

of its major shareholders is related to the Lundin family.

Africa Oil will pay Lundin Petroleum consideration of approximately USD 20

million, which will be funded through a loan from Lundin Petroleum to Africa Oil

maturing 31 December 2011 and bearing interest at USD six-month LIBOR plus 3

percent. This loan will be convertible into shares of Africa Oil on the basis of

CAD 0.90 per share.

Completion of this transaction remains subject to all applicable government and

partner approvals.

Ashley Heppenstall, President and CEO of Lundin Petroleum comments "We have been

very successful over the past several years in building a portfolio of

exploration assets in East Africa. The strategy to grow our business in East

Africa was particularly driven by the prospectivity of our exploration acreage

in Sudan. In view of last years disappointing drilling results in Sudan, our

East African acreage has less materiality to us and as a result we have decided

to divest our interests. Our exploration efforts will continue to be focused on

Norway, Russia and South East Asia."

Lundin Petroleum is a Swedish independent oil and gas exploration and production

company with a well balanced portfolio of world-class assets in Europe, Africa,

Russia and the Far East. The Company is listed at the Nordic Exchange, Sweden

(ticker "LUPE").

For further information, please contact:

C. Ashley Heppenstall,

President and CEO

Tel: +41 22 595 10 00

or

Maria Hamilton

Head of Corporate Communications

Tel: +41 22 595 10 00

Tel: 08-440 54 50

http://www.lundin-petroleum.com/Press/pr_corp_05-02-09_e.html |